Buy Crypto

Assets

Crypto staking offers you a way to earn passive income on your cryptocurrency holdings, similar to how a traditional savings account earns interest. Instead of just letting your digital assets sit idle in a wallet, staking allows you to put them to work and grow your holdings over time. A key metric in crypto staking is APY - Annual Percentage Yield. APY represents the estimated annual return you might earn on your staked cryptocurrency.

It's important to note that APY does not always offer a guaranteed return. Factors like market conditions, network performance, and the specific cryptocurrency you're staking can all influence your realized earnings.

This article will explain APY, how staking works, the potential benefits, and some risks to be aware of. We will also provide a step-by-step guide on how to get started with Atomic Wallet native staking features.

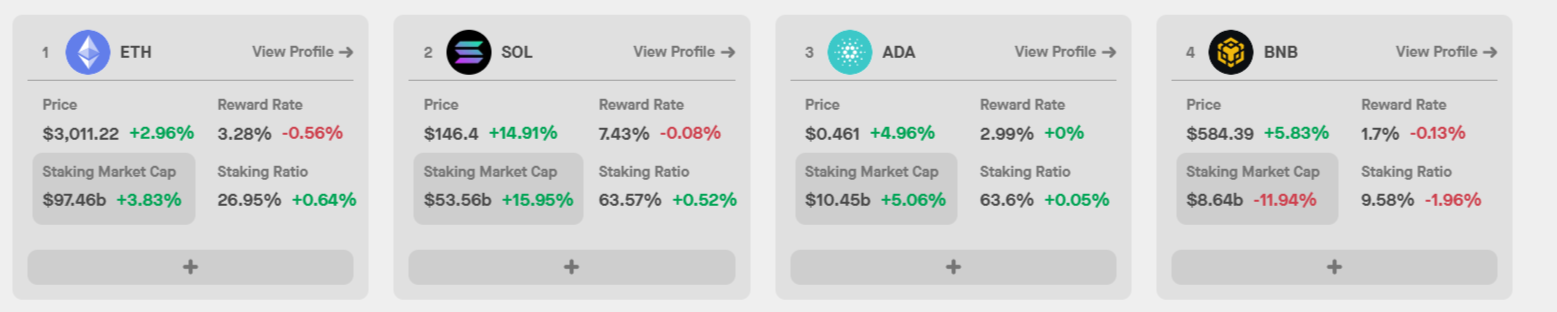

Some of the most popular cryptocurrencies offer substantial APY for staking. Source: StakingRewards

APY, or Annual Percentage Yield, is a crucial metric in crypto staking. It represents the estimated annual return you can expect to earn on your staked cryptocurrency. Think of it as the interest rate for your staked crypto assets. The higher the APY, the greater the potential return on your investment.

For example, since transitioning to a Proof-of-Stake (PoS) consensus mechanism, Ethereum (ETH) staking has offered an APY of around 5%. This means that if you were to stake 1 ETH, you could earn roughly 0.05 sETH (Staked Ether) over a year. As of writing, over $28 billion worth of ETH is staked on the Lido Ether staking protocol, highlighting the popularity of ETH staking.

It's important to remember that APY rates can fluctuate over time, based on several factors, including:

Understanding APY is essential for making informed decisions about crypto staking. It helps you compare potential returns across different cryptocurrencies and staking platforms.

Lido is the most popular liquid ETH staking solution. Source: CoinGecko

APY staking offers several advantages for crypto investors. Here are some key benefits:

While APY staking offers attractive benefits, it's important to remember that cryptocurrency markets are volatile. Research both the specific cryptocurrency you want to stake and the staking platform before investing any amount. Furthermore, there are some potential downsides to staking that should be considered before locking up your stash of ETH or SOL.

While APY staking presents potential benefits, it's essential to be aware of the associated risks before investing your cryptocurrency:

Once familiar with the benefits and risks of staking your crypto, you can choose a staking platform or become a network validator. Since becoming a validator requires a considerable stash of crypto and expensive computer hardware, most users opt to stake through platforms that delegate crypto to validators. Atomic Wallet offers this feature for dozens of cryptocurrencies directly in the wallet.

Atomic Wallet offers a convenient way to start APY staking various cryptocurrencies directly within its user-friendly interface. We'll use Solana (SOL) as an example, but the basic process is similar for most supported assets. Here's a step-by-step guide:

Atomic Wallet simplifies the staking process across various supported cryptocurrencies, not only Solana (SOL), however, it's crucial to understand the basics of staking and the specific factors influencing APY returns for each cryptocurrency.

Thoroughly research any validator before delegating your tokens to them. Remember, cryptocurrency markets are inherently volatile, and APY staking carries risks. Always ensure you understand these risks before investing.

Calculating your potential APY staking returns is helpful when making investment decisions. While APY can fluctuate, a basic formula can provide an estimated return. For convenience, Atomic Wallet offers a built-in APY staking calculator. The calculator lets you input your desired cryptocurrency, the amount you want to stake, and the staking period. It will then provide estimated returns in daily, monthly, and yearly increments.

For example, let's say you want to stake 10 Ethereum (ETH) using the Atomic Wallet calculator. If the current APY for ETH staking is 5%, the calculator could display the following estimated returns: daily profit - 0.0013 ETH, monthly profit - 0.041 ETH, yearly profit - 0.5 ETH. The calculator will also show the approximate USD value of your ETH holdings, to put them into real-world terms.

Atomic Wallet’s staking calculator provides an estimate of daily, monthly, and yearly returns on staked assets. Source: AtomicWallet

To increase your potential earnings from APY staking, consider these strategies. Firstly, compare APYs across different platforms and cryptocurrencies, since they offer varying rates. Research and choose options with higher APYs for potentially greater returns. For example, if Cardano (ADA) offers a 4% APY and Polkadot (DOT) offers a 10% APY, staking DOT might yield higher rewards, assuming all other factors remain equal.

Secondly, on networks that utilize validators, select validators with a strong track record, high uptime, and reasonable fees. Validators with poor performance or excessive fees can decrease your overall earnings even if the base APY seems attractive. The more established a platform is, the better, so avoid getting lured in by unrealistic returns on overpromising platforms.

Thirdly, take advantage of platforms that automatically compound your staking rewards, adding them back into your staked amount and potentially increasing your future earnings over time. Remember, as Albert Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn't … pays it.”

APY staking offers a potential avenue for earning passive income on your cryptocurrency holdings. By understanding APY, the benefits, and the inherent risks, you can make informed decisions about incorporating staking into your investment strategy. As always, it's crucial to remember that cryptocurrency markets are volatile and we should expect the unexpected.

Thorough research, due diligence to select reliable platforms or validators, and understanding the specific cryptocurrency you're staking are all essential. Staking can be a valuable tool within a well-diversified crypto portfolio, allowing you to potentially earn rewards while directly supporting the security of your chosen blockchain network.

Disclaimer: The information provided in this blog is for informational purposes only and does not constitute financial advice. Cryptocurrency markets are highly volatile; always conduct thorough research and invest at your own risk.