Buy Crypto

Assets

In cryptocurrency trading, the term "liquidation" can strike fear into the hearts of investors. It happens when a trader can no longer meet the margin requirements for a leveraged position. Understanding how liquidations work, why they occur, and ways to potentially avoid them is crucial for anyone trading cryptocurrencies with borrowed funds. Let's dive into the mechanics of liquidation and how to manage your risk.

Crypto liquidation refers to the closing of a trading position by converting a cryptocurrency asset to fiat currency or stablecoins, often executed at levels less favorable than the current market price. This happens when a trader has insufficient funds to keep a leveraged trade open.

Liquidation is not exclusive to cryptocurrency. It's a common occurrence in various forms of trading, including futures trading, where it typically happens when a trader borrows money to enhance their position or lacks sufficient capital to keep the position open. This can happen either voluntarily or involuntarily.

There are two main types of crypto liquidation. The first is partial liquidation, where a trader cashes out to prevent losing the entire trading stake before depleting the initial margin, either voluntarily or based on an agreement. The second is total liquidation, where the entire trading balance is sold off to offset losses, often occurring in forced liquidation.

In the realm of cryptocurrency, the term liquidation refers to when an exchange forcefully closes a trader's leveraged position due to a partial or total loss of the trader's initial margin. This typically happens in futures trading when a trader borrows money to enhance their position or lacks sufficient capital to keep the position open. There are two primary types of crypto liquidation: Voluntary liquidation and forced liquidation.

Voluntary liquidation occurs when a trader decides to cash out their cryptocurrency from a losing trade. This decision is often driven by a desire to minimize losses and preserve whatever capital remains in the trader's account. It's noteworthy that voluntary liquidation can also lead to partial liquidation, where a trader cashes out to prevent losing the entire trading stake before depleting the initial margin.

This action is taken by the trader and is often seen as a strategic move in response to unfavorable market conditions. While it can result in a loss, it also enables the trader to retain some of their investment and potentially reinvest it at a more opportune time.

Forced liquidation, on the other hand, occurs when the lender (be it a crypto exchange, smart contract, or broker) closes the position to prevent further losses and protect their capital. This usually happens when the trader's margin balance falls below the required maintenance margin, triggering a forced sale of assets.

Forced liquidation is designed to protect the lender's interests and can lead to total liquidation, where the trader loses their entire invested capital. In extreme cases, this can even result in negative balances, leaving the trader in debt to the lender.

One key aspect of forced liquidation is that it's not a decision made by the trader, but an action taken by the lender in response to a critical situation. While it can be a harsh reality for traders to face, it's a necessary measure to ensure the stability and integrity of the market.

Understanding the differences between voluntary and forced liquidation can help traders make informed decisions about their investments. By considering these factors, traders can better manage their risk and potentially avoid the undesirable outcome of complete liquidation.

Understanding the process of crypto liquidation is crucial for traders and investors looking to navigate the volatile landscape of cryptocurrency trading. In essence, liquidation in trading refers to the process of converting assets into cash or cash equivalents by selling them on the market. This process specifically involves closing positions, either voluntarily by the trader or forcibly by the broker, usually triggered by a margin call. In the context of futures trading, liquidation commonly occurs when a trader borrows money to enhance their position or lacks sufficient capital to keep the position open.

The first type of crypto liquidation is partial liquidation. This occurs when a trader decides to cash out a portion of their stake to prevent losing the entire trading balance prior to depleting the initial margin. This can be an active decision made by the trader, or it may be based on an agreement stipulated in the contract.

Partial liquidation allows for the preservation of some capital, offering the trader a chance to reassess their strategy, adjust their position, or possibly exit the market altogether if they deem it too risky. It's important to note that liquidation can occur before the initial capital is depleted in some cases, illustrating that the process is not solely contingent on the complete loss of the initial investment.

The second type of crypto liquidation is total liquidation. This generally occurs in instances of forced liquidation. Forced liquidation is a protective measure that aims to prevent further losses by closing a trader's position.

In the case of total liquidation, the entire trading balance is sold off to offset losses. This often results in the trader losing their entire invested capital. In extreme cases, traders may even end up with negative balances.

Total liquidation is a drastic measure that underscores the importance of understanding and managing the risks associated with futures trading. It illustrates the potential consequences of failing to maintain an adequate margin or engaging in overleveraging, which can lead to significant financial loss.

By understanding the process of partial and total liquidation, traders and investors can better manage their risk, make informed decisions about their trading strategies and ultimately, protect their investment capital. As with any form of trading, knowledge is power, and understanding 'what is crypto liquidation' is a key component of a comprehensive trading strategy.

Understanding what leads to crypto liquidation is important for traders and investors. Two key factors often come into play: market volatility and the inherent risks of margin trading.

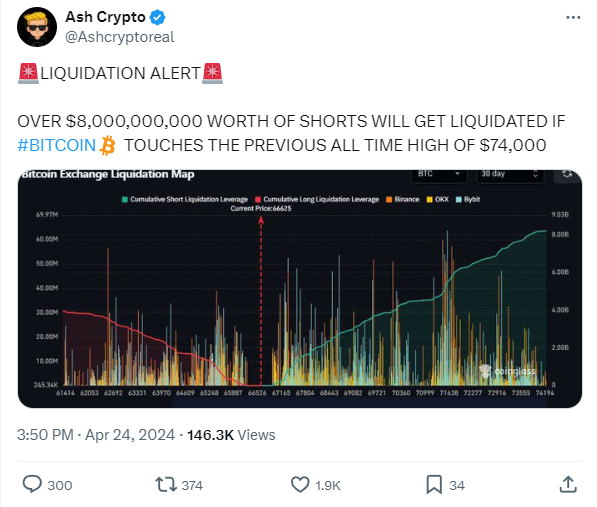

The cryptocurrency market is well-known for its high volatility. Bitcoin and other cryptocurrencies are high-risk investments prone to extreme price swings. This volatility means liquidations are a frequent occurrence. For instance, if there's a significant drop in the price of a cryptocurrency, it could lead to liquidation.

A trader's position could be closed due to the market moving in the opposite direction of the trade, leading to the trader not meeting the margin requirements. This results in automatic closure of the position at the liquidation price. The severity of the loss depends on the initial margin and the extent of the price drop.

Market liquidity can also affect the ease and impact of liquidation. In highly liquid markets, liquidation is generally smoother and less likely to significantly impact market prices.

Margin trading involves borrowing third-party funds to increase the amount of money available for trading. A crypto exchange requires an initial margin as collateral to open a leveraged position. The amount of money that can be borrowed from an exchange relative to the initial margin is determined by the leverage. For example, using 5x leverage on an initial margin of $100 allows for a $400 loan to increase the trading position to $500.

Liquidation occurs when a trader fails to have sufficient funds to keep the trade open, leading to the partial or total loss of the initial margin. Exchanges need to forcefully close the position to prevent further losses.

Liquidation can be triggered by a margin call, significant losses, or a trader's decision to close positions for profit or loss mitigation. It can result in either a loss or a profit, depending on the position's performance at the time of closing.

Both market volatility and the risks associated with margin trading play significant roles in influencing crypto liquidation. Traders should keep these factors in mind when participating in the volatile world of cryptocurrency trading.

When it comes to preventing liquidation in cryptocurrency trading, the two key strategies are setting stop-loss orders and maintaining a sufficient margin balance. Both strategies are crucial in managing the risks associated with rapid market fluctuations.

A stop-loss order is an advanced order placed on a crypto exchange, designed to mitigate the chances of being liquidated. This order works by automatically executing a sell order at a particular price point, set by the trader. If the value of the cryptocurrency falls to this predetermined level, the stop-loss order is triggered, and the cryptocurrency is sold. This limits the trader's loss on a specific trade, helping to prevent liquidation.

Traders can protect their trading positions by setting stop-loss orders that specify the price at which a transaction will be liquidated if the asset's price hits a certain level. However, it's important to note that stop-loss orders are not a guarantee against liquidation, especially in volatile markets where prices can change rapidly.

To avoid liquidation in crypto trading, traders can mitigate the risk by determining the risk percentage they are willing to allocate towards a trade. It is generally recommended to risk only 1% to 3% of the account per trade. By using a stop-loss order to limit potential losses in case a trade goes wrong, traders can manage their risk effectively.

Another effective strategy for preventing liquidation is maintaining a sufficient margin balance in the account. This is particularly necessary in futures trading, where the margin ratio needs to be higher than the maintenance margin rate. If the margin ratio falls below the maintenance margin rate, the trader's position may be liquidated.

Regularly checking the margin ratio can help prevent liquidation due to falling below the maintenance margin rate. By ensuring that there is always a sufficient margin balance in the account, traders can continue to hold their positions, even during periods of market volatility.

In conclusion, preventing liquidation in crypto trading requires proactive risk management. By setting stop-loss orders and maintaining a sufficient margin balance, traders can protect their investments and navigate the volatile crypto market more effectively. Remember, while these strategies can significantly reduce the risk of liquidation, they do not eliminate it entirely. Always trade with caution and never invest more than you can afford to lose.

The theoretical understanding of crypto liquidation is important, but examining real-world cases can bring clarity to the concept. This section will explore a few case studies of crypto liquidation and draw lessons from these market events.

In the world of cryptocurrencies, liquidation can have severe consequences. In recent times, there have been several high-profile cases of crypto liquidations, resulting in significant losses for both the companies involved and their investors.

These lessons emphasize the importance of understanding what is crypto liquidation. It's not just a theoretical concept but a real phenomenon with tangible impacts. Investors and traders should take these lessons to heart and implement effective risk management strategies to navigate the volatile crypto markets safely.

Crypto liquidations are a harsh reality of trading in a volatile market, particularly when using leverage. Understanding the mechanics of liquidation, the factors that trigger it, and strategies for mitigation are essential for any trader. By employing stop-loss orders, maintaining adequate margins, and being aware of the inherent risks, traders can reduce the likelihood of liquidation and increase their chances of success in the dynamic world of cryptocurrency investing.

This article explores the benefits, risks, potential rewards, and important considerations to help you decide if staking SOL aligns with your investment goals and risk tolerance.